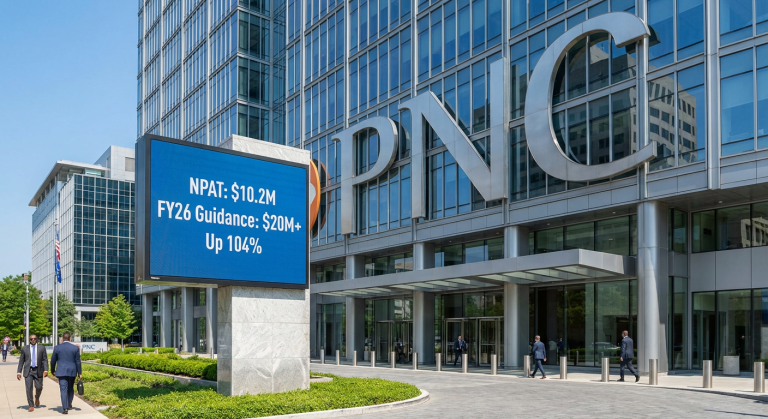

Pioneer Credit doubles profit and lifts FY26 guidance to $20m

Pioneer Credit has upgraded its FY26 NPAT guidance by $2m to at least $20m, following a strong first half that saw statutory profit more than double. The Pioneer Credit FY26 NPAT upgrade reflects continued momentum from FY25, with 1HY26 profit of $10.2m exceeding the entire FY25 result.

The company’s statutory NPAT for the six months ended 31 December 2025 increased 104% from $5.0m in 2HY25. Net revenue rose 5% to $47.7m on cash collections of $71.4m, demonstrating improved portfolio economics that underpinned the margin expansion.

The upgraded guidance provides near-term earnings visibility for shareholders, with the half-year result signalling an accelerating earnings trajectory. The company’s Managing Director noted the result exceeded expectations set at the beginning of FY25.

Keith John, Managing Director

“At the beginning of FY25 we outlined a clear pathway to our FY26 guidance. By the end of FY25 we were ahead of those expectations, and this momentum has continued. 1HY26 Statutory NPAT exceeded the full FY25 result, reflecting strong strategy execution and delivery on our commitment to shareholders. We are pleased to upgrade our FY26 Statutory NPAT guidance to at least $20m.”

What’s driving Pioneer Credit’s margin expansion

Pioneer’s operational performance during 1HY26 demonstrated disciplined cost management despite inflationary pressures. EBITDA rose 7% to $51.5m, while EBIT jumped 38% to $26.2m, reflecting operational leverage across the platform.

The company maintained its Cost to Service at 32%, below the guided range of 33%-35%. This performance was supported by ongoing investment in systems, data analytics, and process optimisation. Total expenses remained in line with 2HY25 despite inflationary pressures, reflecting the discipline within the business.

| Metric | 1HY26 | 2HY25 | Change |

|---|---|---|---|

| Cash Collections | $71.4m | $70.7m | +1% |

| Net Revenue | $47.7m | $45.4m | +5% |

| EBITDA | $51.5m | $48.3m | +7% |

| EBIT | $26.2m | $19.0m | +38% |

| NPAT | $10.2m | $5.0m | +104% |

Revenue growing faster than collections indicates improved portfolio economics, with Pioneer’s long-term purchased debt portfolio investment discipline and preferential market position underpinning the margin expansion.

Funding cost savings ahead of expectations

Pioneer repriced its senior facility during the period, securing a 100bps margin reduction. Shortly thereafter, the company achieved a further 15bps reduction under ESG-linked provisions, bringing the cost of senior funding to BBSW + 435bps.

The repricing delivered a $3.8m benefit, which was $1.8m ahead of expectations. These changes lowered the company’s cost of funds, with the benefit flowing directly to the bottom line. The improved funding terms signal strengthening lender perception of Pioneer’s credit quality.

The company continues to assess opportunities to further optimise its funding structure, suggesting potential for additional margin improvement.

Understanding purchased debt portfolios

Pioneer Credit operates by acquiring portfolios of non-performing consumer debts from banks and credit providers at a discount to face value. These purchased debt portfolios (PDPs) form the core of the company’s business model.

The company works with customers to establish affordable repayment plans that suit their individual circumstances. Returns are generated when collections over time exceed the discounted purchase price paid for the portfolio. Investment discipline means Pioneer only acquires portfolios at prices expected to deliver target returns.

This business model explains why the Pioneer Credit FY26 NPAT upgrade is significant. Disciplined PDP investment combined with operational efficiency creates sustainable earnings growth, as the company can generate returns from both new portfolio acquisitions and the existing book.

Understanding this model helps investors assess portfolio quality and the sustainability of margin expansion, both of which underpin the upgraded profit guidance.

Portfolio investment on track despite market pause

Pioneer invested $30.8m in purchased debt portfolios during 1HY26, with year-to-date investment reaching approximately $50.0m. The company expects to meet its FY26 PDP investment guidance of at least $80m, with scope for incremental investment where pricing and portfolio quality are attractive.

Market conditions during the half were affected by a temporary pause in forward flow sales as vendors reviewed processes to align with evolving best-practice standards, particularly around hardship management and treatment of customers. Sales activity resumed in late December.

The market pause and its resolution followed this sequence:

- Vendors initiated industry-wide process reviews focused on hardship management standards

- Sales activity resumed in late December following completion of vendor reviews

- Remaining contracted investment for 2HY26 positions Pioneer to meet full-year guidance

- The company retains capacity for additional investment where pricing remains attractive

Pioneer noted these industry-wide reviews are consistent with the company’s longstanding approach. The company’s existing practices being aligned with evolving standards reduces regulatory risk for the business.

Meeting investment guidance ensures future earnings capacity, as PDPs acquired today generate returns over subsequent years. The contracted pipeline provides visibility on earnings growth beyond FY26.

What comes next for Pioneer Credit

Pioneer enters the second half of FY26 with an improved operational foundation following the strong first half performance. The company’s resilient portfolio and enhanced funding economics support the upgraded guidance of at least $20m statutory NPAT for FY26.

The upgraded guidance provides a floor for full-year expectations, with 1HY26 profit of $10.2m representing more than half the upgraded target. Ongoing funding optimisation suggests potential for further margin improvement, while the contracted PDP investment pipeline underpins future earnings capacity.

Keith John, Managing Director

“The Company enters the second half of FY26 with a resilient portfolio, improved funding economics, and a strengthened balance sheet. This underpins our confidence in achieving our upgraded FY26 Statutory NPAT guidance of $20m.”

The combination of operational discipline, funding cost reductions, and continued portfolio investment positions Pioneer Credit (ASX: PNC) for sustained earnings growth. The company’s ability to maintain Cost to Service below guidance while growing revenue demonstrates operational leverage, with benefits flowing through to bottom-line profit.

Don’t Miss the Next Financial Services Winner

Join 20,000+ investors receiving FREE breaking ASX news within minutes of release, complete with in-depth analysis. Click the “Free Alerts” button at StockWire X to get market-moving announcements from financials, tech, healthcare and consumer sectors delivered straight to your inbox the moment news breaks.